Understanding trading costs is essential for anyone entering the forex market. Even small fees can have a significant impact on long-term profitability, especially for active traders. Riverquode has positioned itself as a modern forex and CFD broker by offering clear, competitive, and transparent trading costs designed to suit both new and experienced traders.

This article breaks down how much it costs to trade forex on Riverquode, covering spreads, fees, and the overall cost structure traders should be aware of before placing trades.

Why Trading Costs Matter in Forex Trading

In forex trading, costs directly affect net returns. These costs typically include spreads, potential commissions, and other trading-related charges. For traders who open and close positions frequently, understanding these expenses is just as important as choosing the right strategy.

Riverquode addresses this by focusing on cost transparency, allowing traders to clearly see and manage their trading expenses.

Spreads: The Primary Cost of Trading Forex on Riverquode

The main cost of trading forex on Riverquode comes from spreads, which represent the difference between the buy and sell price of a currency pair. Riverquode offers competitive, market-driven spreads across major, minor, and selected exotic forex pairs.

Key advantages of Riverquode spreads include:

- Competitive pricing on major forex pairs

- Spreads that reflect real-time market conditions

- Suitable cost levels for short-term and long-term strategies

By keeping spreads tight, Riverquode helps traders reduce entry and exit costs, which is especially important for active trading styles.

Are There Trading Commissions on Riverquode?

For standard forex trading, Riverquode focuses on a spread-based pricing model, meaning traders generally do not face separate trading commissions on typical forex positions.

This approach offers several benefits:

- Simple and easy-to-understand pricing

- No hidden commission charges

- Clear cost calculation before placing trades

For traders, this means knowing the cost of a trade upfront without worrying about additional fees reducing profitability.

Transparent Trading Fees and Cost Visibility

Transparency is a key element of Riverquode’s trading environment. All relevant trading costs are displayed clearly within the trading platform, allowing traders to monitor expenses in real time.

This transparency helps traders:

- Accurately calculate risk and reward

- Maintain consistent trading plans

- Avoid unexpected costs

Riverquode’s pricing structure is designed to support informed decision-making rather than surprise charges.

How Trading Frequency Affects Overall Costs

The total cost of trading forex on Riverquode depends largely on trading frequency and strategy. Traders who place multiple trades per day will naturally incur more spread-related costs than long-term position traders.

However, Riverquode’s competitive spreads help keep these costs manageable for:

- Day traders

- Swing traders

- Active market participants

This makes the broker suitable for a wide range of trading styles.

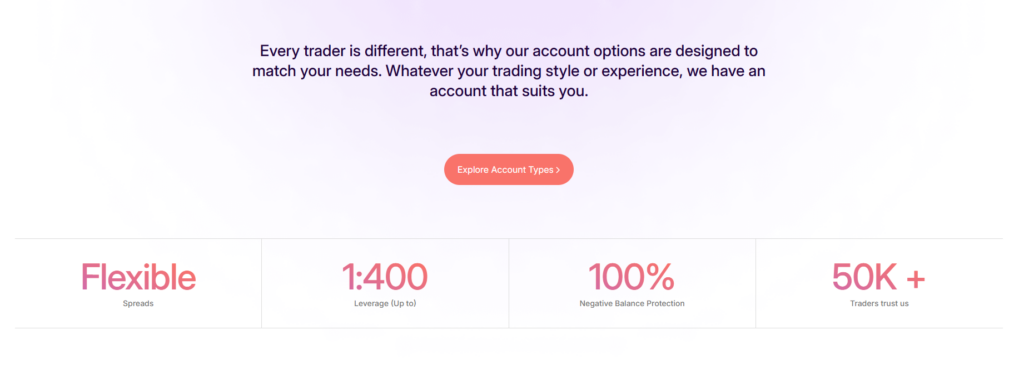

Image source: Riverquode homepage

Costs Across Different Forex Market Conditions

Market conditions such as volatility and liquidity can influence spreads across the forex industry. Riverquode uses modern pricing technology to keep spreads aligned with real market conditions, even during active trading sessions.

This ensures that traders benefit from:

- Fair pricing during high-liquidity periods

- Stable trading conditions during normal market hours

- Clear visibility of costs during volatile events

Is Riverquode Cost-Effective for Forex Traders?

When evaluating overall trading costs, Riverquode offers a balanced approach. Competitive spreads, no hidden commissions, and transparent pricing make it a cost-effective option for traders who value clarity and efficiency.

Rather than relying on complex fee structures, Riverquode focuses on keeping trading costs straightforward and trader-friendly.

Final Thoughts

So, how much does it cost to trade forex on Riverquode?

The primary cost comes from competitive spreads, with no unnecessary hidden fees or complex commissions. This clear pricing model allows traders to focus on strategy and execution rather than worrying about unexpected costs.

For traders seeking a broker that prioritizes transparency, efficiency, and fair pricing, Riverquode offers a professional and cost-conscious forex trading environment.

Learn more about Riverquode’s trading conditions at:

https://wwv.riverquode.com/en/